|

|

|

|

CIAO DATE: 04/01

Moving Beyond Kyoto

Warwick J. McKibbin

Policy Brief #66

October 2000

In November 2000, just after the presidential elections in the United States, negotiators will meet in The Hague at the sixth meeting of the Conference of the Parties (COP6) to the United Nations Framework Convention on Climate Change (UNFCCC). By then, it will have been almost three years since the negotiation of the Kyoto Protocol on global climate change at COP3, which was held in Kyoto in December 1997. Intense negotiations over the intervening period have focused on how to implement the Kyoto Protocol. The Kyoto Protocol has been signed by 84 countries but not ratified by any of the key countries, and ratification does not appear to be imminent, especially in the United States, where the Senate has registered its strong opposition.

Why has it been so difficult to take the next step of implementing the Kyoto Protocol? The simple answer is that mechanisms within the Protocol are too complex and require too many new institutional developments to be plausible. The fundamental answer is that the Kyoto Protocol is never going to work because it is the wrong approach to tackling the climate change issue.

The core issue about climate change is how to design a policy response in an environment of considerable uncertainty. There is enough evidence and professional expertise to suggest that climate change could be a serious problem. What is required is an insurance policy against the possibility that climate change could be very costly to the planet. The key question is: how much insurance is needed, given the current state of our understanding? The answer is that we don't really know what price we should pay now. We also don't know by how much nations should reduce carbon dioxide emissions or how quickly.

Nonetheless, the Kyoto Protocol consists of a specific set of targeted reductions in emissions: 5.2 percent for Annex I countries, relative to 1990 emissions, between 2008 and 2012. Annex I countries, which are listed in Annex I of the UNFCCC, are essentially industrialized economies and include several countries that were part of the former Soviet Union which are in transition to market economies.

The target was set even though the negotiators had no way of knowing how costly it would be to attain. Understandably, countries are reluctant to implement a policy that could potentially be very costly and whose benefits are uncertain. Although there is some flexibility built into the Protocol to smooth costs across countries, the total cost results from the overall targets.

More importantly, only a subset of countries are part of the agreement and those countries are expected to create new international institutions and laws that can accommodate the various mechanisms at the foundations of the Protocol. The most problematic are international trading of emission permits, which requires a system of monitoring and enforcement that is unlikely to be feasible in the near future, and the Clean Development Mechanism, which requires detailed and costly evaluation of carbon-reducing investment proposals in developing countries on a project by project basis.

Solving the Problem

So what can be done? A number of realistic proposals have been made. One, from Resources for the Future, a Washington, D.C.-based environmental research organization, would place a cap on the prices of emission permits that each nation would issue. This would guarantee that the cost of implementing the Protocol would not exceed a set level.

An alternative is the McKibbin-Wilcoxen (MW) Proposal, devised by the author and Peter J. Wilcoxen, a professor of Economics at the University of Texas at Austin. It proposes a fundamental re-thinking of the approach embodied in the Kyoto Protocol—fixed targets and the international trading of emission permits. Both proposals have evolved over time and can be considered "early action policies," while countries still attempt to solve the problems with the Kyoto Protocol. This brief lays out the key features and advantages of the MW proposal and its attractiveness as an early action policy.

The McKibbin-Wilcoxen Proposal

Rather than centralize the process of reducing carbon emissions and creating new international institutions, it is better to coordinate responses across countries (what Richard Cooper of Harvard calls an approach of agreed actions) in an explicit way so that each country would pay the same price for emitting carbon. Furthermore, it is appropriate at this stage to create property rights over emissions of carbon dioxide from burning fossil fuels only. While it would be nice to include alternative gases and sinks as part of a policy, as in the Kyoto Protocol, it is an administrative nightmare to deal with them in the near term and adds enormous complexity to the task. In the future these could likely be added without compromising the system.

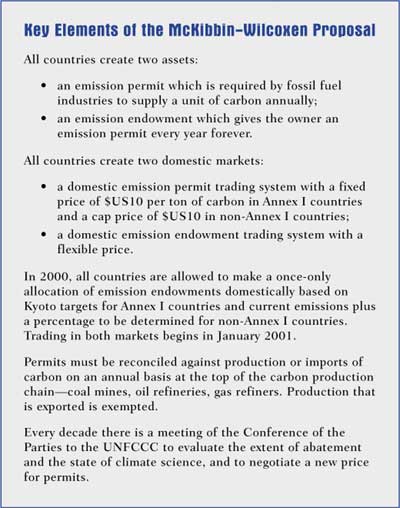

The key innovation of the MW proposal is that it would create two emissions-related assets and associated markets for both in each country. The two assets are designed to set a long-term goal for emissions and limit the short-run costs. Fortunately, the two markets also would create a mechanism for managing risks associated with climate change policy within each economy so that little else would need to be done to implement a consistent and simple market-based approach to tackling the climate change issue.

The first asset is an emission permit. This certificate would entitle its holder to produce one unit of carbon per year. Each permit would have a date stamp and be valid only in the year issued. The second asset is an emission endowment, which is a certificate that would permanently entitle the holder to an annual emission permit. The emission endowment is like a government bond, or like stock in a corporation, while the emission permit is the dividend the corporation pays each year to people who hold the shares. The stock value is the expected value of future dividends.

There is a critical difference between the two asset markets. The endowment market would be one in which the supply of carbon is fixed (the goal of policy) but the price is flexible. The government cannot issue more endowments after the initial allocation but can buy back endowments in future years if the target for emissions is to be tightened. Because the endowment is perpetual, its price would reflect the expected future price of emission permits in each year (which is analogous to the relationship between the stock price and the dividends of a company).

We treat the market for emission permits—where the price is fixed, but the output of carbon is variable—quite differently because the permit market is directly related to the short-run cost of carbon. Every ten years, there would be a negotiation between all countries in which the price for emission permits is agreed to and fixed for the next decade. The price of permits would be fixed in each economy by governments selling additional permits into the market after the permits generated by the endowments have been fully utilized. Thus, a producer that wants to produce a unit of carbon for domestic use can get a permit in a given year by either having an existing emission endowment, purchasing an emission endowment in the endowment market (sold by another private holder of an endowment), or purchasing an emission permit in the permit market that is either supplied by a private owner of a permit or the government.

We propose that the initial price of the annual permits—which would determine the marginal cost of emitting carbon—be set at $10 (U.S.) per ton of carbon, in 1990 dollars. The price would be the same in all markets in all participating countries, and thus the cost of removing carbon at the margin in each economy would be identical in the short run. No complicated system of international trading in permits or global monitoring would be required—addressing a central flaw in the current Kyoto Protocol. Moreover, the value of permits in the United States would not depend on how permits are generated in other countries.

In contrast, the price of endowments would be flexible, reflecting the outcome of market forces, the period of fixed permit prices in the near future, and the expectations of private actors as to what is likely to happen after the current negotiation period. In making spending and investment decisions, industry and consumers would be expected to respond to both the short-run price signals—which are known for ten-year periods—as well as the long-run price signals, which are market determined. The purpose of separating the endowment market from the emissions market is to ensure that, over the long run, emissions do not exceed a given limit. The annual emissions permitting process cannot accomplish this objective since it operates on the basis of a fixed price (the emissions fee), not a fixed quantity.

The initial allocation of endowments would be up to each government. We propose giving a significant portion to fossil fuel industries as compensation to shareholders for the capital losses of significant structural change that would result from raising carbon prices, and to galvanize support for the policy. We also would allocate a portion to every person in the economy. The initial allocation of endowments would create a natural constituency supporting climate change policies because the value of the endowments in future years would depend on the commitment of the government to pursue sound environmental policies. This would create a mechanism for enforcement of the agreement that is exclusive to each country.

How Can Developing Countries Be Induced To Participate?

In discussing carbon emission reductions, it is important to distinguish between Annex I countries and developing countries. Failure to do so would unduly inhibit the growth of the developing world and would not attract their support for a global system that is absolutely crucial for a successful policy.

Accordingly, it is appropriate in the case of Annex I countries to use the Kyoto targets as the endowment allocation within each economy. For developing countries, however, it is only reasonable to allow endowments far in excess of current requirements (the precise levels being subject to international negotiation). With endowments greater than requirements for permits over the next several decades, the price of permits in these countries would be zero, and thus there also would be no short-run costs. In contrast, the price of endowments in developing economies would be positive, since the price would reflect the expected future price of permits. Thus, a price signal can be introduced to the developing world that will affect current investment plans without entailing short-run costs.

A developing country can therefore begin to contribute to a reduction in emissions with a firm commitment in the form of endowments. This reduction will be realized, however, only when emissions actually bump up against the endowment limit. The faster a country's economy grows, and thus the faster pace at which emissions are growing, the more rapidly the endowment constraint will become binding.

Meanwhile, carbon intensive industries will have fewer incentives to move from Annex I countries into developing countries in order to avoid the carbon charge in industrial countries, because all countries will be participating in the overall emissions reduction program. The differential endowment system—one for first world countries, another for developing countries—also would have the added benefit of factoring in the cost of emissions in decisions by foreign private investors when decisions are made about whether to commit funds to developing countries.

Overall, the nationally-based emissions permit and endowment program is far more appealing than the Kyoto Protocol. All institutions would be created and managed within each economy. Breakdowns in the infrastructure of any given market would not spill over to markets in other countries. To be sure, there would be fluctuations in the amount of global emissions, but such variations would be within a downward trend. Furthermore, decentralizing responsibility for taking action to individual countries would make the whole program more sustainable than the Kyoto alternative, which requires participation by all countries in an international permit-trading regime.

Another advantage of the approach proposed here is that the decennial negotiation on the permit price would allow a great deal of flexibility. Monitoring of emissions and the extent of induced abatement activities could be undertaken more easily than in a global program. If information changes, then the price of permits could be changed by international agreement. The endowment market would reflect this information immediately and would enable more rapid but cost-minimizing adjustment, if required.

An Early Action Proposal

The permit and endowment approach can and should be easily implemented in the United States and all other countries as an early action policy. By establishing such a system with a low initial price for permits, all domestic institutions that would be required—if and when the Kyoto Protocol is implemented—would be created in the meantime. To move from the fixed price system that we propose to a flexible price system under the Kyoto Protocol, all that is required is to remove the government intervention from the permit market in 2008 and allow international trading of the permits at the same time. Alternatively, and more likely, countries that implement the MW proposal would find that it works so well in providing price signals to consumers and industry that there will be no need to move to the Kyoto style system in the coming years.

Summary The key objective for those interested in promoting responsible climate change policy is to allow each country to run its program without depending on other countries but on an overall framework that provides constructive incentives for private actors to control emissions efficiently. The proposal outlined here would accomplish this objective, ensuring sufficient flexibility for private actors, providing incentives for developing countries to commit to the system, and creating constituencies within all countries to sustain the agreement—all without the need for cross-border intervention.

Finally, raising the price of carbon by a known amount in the short run would establish the insurance premium to be paid for climate change prevention over coming years, while reducing the short-run uncertainty for investment planning and creating a market that accurately prices carbon emissions for long-run planning purposes. Credible price signals can guarantee that emissions of carbon will be lower than otherwise would have been the case. Perhaps emissions will not be low enough as time proceeds and we gain better information and improved climate science. But a flexible system of emissions reduction can deal with this over time.

Starting now with small but significant action is far better than continuing to argue over the Kyoto Protocol and failing to implement policies that could make a meaningful start toward emissions reduction. The current situation generates enormous uncertainty for investment decisions and compounds the cost of climate change.

[back to text]

Additional Reading for this Policy Brief

Kopp, R., Morgenstern, R., and Pizer, W. "Something for Everyone: A Climate Policy that Both Environmentalists and Industry Can Live With," September 29, 1997, Resources for the Future, Washington, D.C. http://www.weathervane.rff.org/features/feature015.html

Kopp, R., Morgenstern, R., Pizer, W. and Toman, M. "A Proposal for Credible Early Action in U.S. Climate Policy," Weathervane/Resources for the Future, 1999. http://www.weathervane.rff.org/features/feature060.html

McKibbin, W. and Wilcoxen, P. "Salvaging the Kyoto Climate Change Negotiations," Brookings Policy Brief no. 27, November 1997. The Brookings Institution, Washington D.C. http://www.brookings.edu/comm/PolicyBriefs/pb027/pb27.htm

McKibbin W. and P. Wilcoxen. "A Better Way to Slow Global Climate Change" Brookings Policy Brief no. 17, June 1997. The Brookings Institution, Washington D.C. http://www.brookings.edu/comm/PolicyBriefs/pb017/pb17.htm

McKibbin, W., and Wilcoxen, P. "Designing a Realistic Climate Change Policy that includes Developing Countries." Paper prepared for the United Nations University Symposium on "Global Environment and Economic Theory," Oct. 24-25, 1999, Tokyo. http://www.msgpl.com.au/msgpl/download/developing.pdf

Uzawa, H. "Global Warming and Intergenerational Equity." Paper presented at the United Nations University Workshop on "Global Environment and International Cooperation," March 23, 2000, Tokyo.