|

|

|

|

Strategic Analysis:

A Monthly Journal of the IDSA

Economy Post-September 11, 2001

Shalini Chawla

*

, Research Officer, IDSA

Abstract

Pakistan's economy has been on the downswing for the past several years and has been hit by poor crops, political turmoil, social unrest, corruption and sanctions in the past three decades. The aftermath of September 11, 2001 terrorist attacks on the United States has seen a number of developments in the Pakistan economy.

On the one hand have been the negative effects. Multinational companies, big buying houses and shipping lines have scaled down their operations because of uncertainty of war. Pakistan's defence budget, already straining the economy to a near breaking point, is likely to increase. On the other hand, Pakistan's support to the US in the offensive against Afghanistan has resulted in economic benefits from the US and other countries Developments in Pakistan but also from financial institutions such as, the International Monetary Fund and the World Bank. The US sanctions have been waived off and various financial aid packages including fresh loans, rescheduling of debt payments and wider access to international markets have been announced. However, it is difficult to assess whether Pakistan economy will benefit in real terms from these economic packages. Most of the financial aid is the form of fresh loans and loan rescheduling which will provide short-term relief to the economy. Pakistan does have a window to climb out of economic doldrums. It remains to be seen whether Pakistan is able to utilise this temporary reprieve by instituting any long-term measures for revival of the economy.

Pakistan's economy with a low growth rate and increasing debt burden has been on the downswing for the past several years. It has been hit by poor crops, political turmoil, social unrest and corruption in the past decades. Also, the economy was affected adversely by sanctions from the US and its allies from time to time. The terrorist attacks on the United States on September 11, 2001 and the subsequent Pakistan's support to the US in its fight against terrorism have fetched Pakistan the support of the international community. Pakistan has been receiving aid, loans, and other financial concessions from US, Britain, Canada and other nations. This article seeks to study the effects of post-September 11, 2001 events on Pakistan's economy and examines the period September 11, 2001 to January 2002 in order to evaluate whether Pakistan economy got any new lease of life.

State of Economy Before September 11, 2001

Pakistan's economy has been showing a decisively downward trend in terms of growth as can be seen from Table 1.

Table-1: Real GDP (FC) of Pakistan

| Fiscal year | FY98 | FY99 | FY00 | FY01 (estimated) |

|---|---|---|---|---|

| Real GDP(FC) | 4.3 | 4.2 | 3.9 | 2.6 |

In the fiscal year 2000-2001 Pakistan's aggregate growth rate has been only 2.6 per cent against a target of 5.0 per cent. No one would have been surprised when the World Bank placed Pakistan in the same category as Congo and Ethiopia as one of the world's severely indebted low-income countries. 1 According to the Global Development Finance report issued by the World Bank, Pakistan is one of the three countries whose debt burden has increased severely. The other two are Benin and Kyrgyz Republic, which are among the poorest in the world. 2

The sectoral share of agriculture in Pakistan's GDP is approximately 25 per cent. Therefore, vagaries of nature can easily show it's impact on the growth of the economy. Consequently, continuing bad monsoon from 1998-2001 had made a significant negative impact on Pakistan's economy. 3 The fiscal impact of the drought is estimated to be as high as Rs 25 billion. 4 Cotton buds holds a good share in Pakistan's economy. So, the unfavourble weather conditions hurt the cotton based industries, like cotton spinning, weaving and dying. Also, textile and garment manufacturing along with trade and transport activity, are dragged down.

Pakistan was also isolated by sanctions imposed by the US and its allies. The first set of sanctions was imposed in October 1990 under the Pressler Amendment. Pakistan's former Foreign Minister Sartaz Aziz said that these “not only reduced the annual flow of economic assistance but also affected Pakistan's defence capability as the supply of spare parts was also stopped.” 5 The next round of sanctions was imposed after Pakistan went ahead with the nuclear tests in May 1998. “These had a more drastic effect on Pakistan's economy because the US persuaded the other G-7 countries to impose similar sanctions.” 6 These sanctions led to the freeze on most foreign aid and concessional loans. The third set of sanctions was imposed in October 1999 when the democratic process was interrupted with the military takeover. These sanctions barred provision of bilateral US support and financing for military purpose. 7 Mr Sartaz noted that, “as a result of these sanctions the overall level of foreign assistance that had peaked between $3 billion and $3.3 billion (in terms of new commitments) in 1988-1990 came down to $1.5 billion in 1999-2000.” 8

There has been noticeable economic decline in Pakistan with fiscal deterioration. Constant borrowing by one government after another has left the nation facing a massive amount of debt. The Pakistan Economic Survey noted that, “According to Debt Reduction and Management Committee the total stock of external debt obligations which include medium, long term and short term debt as at the end of December 2000 is approximately $37.1 billion.” 9 Since 1984-85 there has been an exponential growth of debt servicing which has threatened the macro-economic stability of the nation. Public debt went up at a rapid pace in relation to the GDP. Domestic debt, as per cent of GDP stood at 43.9 in the fiscal year 1998, 46.8 in 1999, 49.0 per cent in 2000 and 49.2 in 2001. 10 The interest payments on domestic debts have increased from Rs. 35,711 million (3.5 per cent of the GDP) in 1990-91 to Rs. 104,507 million (4.9 per cent of the GDP) in 1995-96 and it increased to Rs 210,155 million (6.6 per cent of the GDP) in 1999-2000. 11

Table-2: Debt Servicing by Pakistan

| Year | 1996-97 | 1997-1998 | 1998-99 | 1999-2000 |

|---|---|---|---|---|

| Total Debt Servicing (as per cent of GDP) |

10.8 | 10.7 | 11.7 | 11.7 |

Table 2 shows the continuous increase in the total debt servicing of Pakistan which has been suffocating the economy.

Despite the fact that Pakistan holds the bad harvest and sanctions responsible for the slow economy, it cannot be overruled that it is also the weak, inconsistent economic policies accompanied by the inefficient leadership which made the path of economic revival tough for Pakistan. 12

State of Pakistan Economy Post September 11, 2001

There have been a number of developments in the economic scenario of Pakistan after September 11, 2001 when Afghanistan became ground zero for the war on terrorism.

Impact on Trade

Soon after September 11, 2001, when the US President George W Bush issued threats and warnings to wage a war against terrorists by attacking Afghanistan, media hype regarding uncertainity of war began to grow. This generated fear in the Pakistani market, and so immediately after September 11, many multinational companies, airlines, shipping lines and big buying houses cut down their operations in Pakistan 13

This clearly gets reflected in President Musharraf's statements that “one of the major concerns for the country was that foreigners working in different projects were leaving Pakistan” and “a number of orders that were placed with our industries have been cancelled and no fresh orders were being placed”. 14

Like many of the developing economies, textile exports constitute the backbone of Pakistan's export strategy. This particular sector seems to have been badly hit following the September 11 developments. 15 The Chairman, Pakistan Readymade Garments Manufacturers and Exporters Association (Prgmea) Masood Naqi said that textile exports comprise around 65 per cent of US$9 billion total exports and because of the steep fall in new orders, there would be loss of around $2.5 to $3 billion in export earnings. 16 September onwards is the time when a large part of commercial activity takes place in the Pakistani textile industry. This is mainly due to the fact that the fresh cotton crops unveil themselves and the traders in Pakistan start receiving Christmas orders from their clients in the US, Europe and the Far East. 17 The impact of these cancellations of orders in the fabric and knitwear industry will be felt in revenue and foreign exchange earnings in due course of time but the negative signs of this are already affecting the vendors, daily wage earners and the small industry. 18

Media reports suggested that not only cancellation of orders was hitting the Pakistani market but also a number of foreign airlines have either closed down their flights to and from Pakistan entirely or partially. Due to this Pakistan's trade has been badly hit. Insurance companies have added war risk charges on all trade to and from Pakistan's shipping ports. 19 Though insurance companies have levied war risk charges on the whole region, for Pakistan these charges are the highest in the world. 20 All these factors made Pakistani products uncompetitive in the international markets. Estimating the losses the Commerce Ministry opined that “exports could decline by $1.4 billion this year as buyers are reluctant to book new orders and some of them have cancelled the old orders. Private sector fears that the loss of exports may be as high as two billion dollars this year.” 21

Pakistan's travel and hotel industry have been badly affected. The fall out of the developments after September 11 brought down the business by approximately 80 per cent during the period September 2001 to January 2002. Due to this more than 30,000 employees have been laid off. 22 Along with this, the airline industry also suffered major set back. PIA (Pakistan International Airlines) has suffered a big loss. PIA estimated a profit of Rs 130 million for the period of September 2001. But contrary to this, the airline suffered a loss of Rs 300 million in October. It is expected that a large number of workforce in this area would also be laid off. 23

Increase in the Defence Budget

The centrality of the Pakistani armed forces since independence resulted in higher allocation to defence. This trend continued. (See Table 3)

Table-3: Pakistan Defence Expenditure

| Fiscal year | Defence Expenditure (Rs million) |

|---|---|

| 1996-97 | 127,441 |

| 1997-98 | 136,164 |

| 1998-99 | 143,471 |

| 1999-2000 | 150,390 |

| 2000-2001 (M.B.E) | 157,500 |

Even though Pakistan's fragile economy has been unable to support the high defence expenditure, the military spending in Pakistan has been at the cost of development expenditure. An additional factor, post-September 11, straining the Pakistan economy is the increase in the defence budget. It has been reported that the government is expecting significant increase in its defence and law enforcement budgets due to the developments taking place after September 11. 24 The Finance division in fact states that balance of payments and the budget 2001-2002 are likely to be affected. The unwanted developments will negatively impact the current account deficit situation by raising the overall financing requirements of the military government. 25

Estimated Cost of War

It is difficult to assess, and it is too early to tell, what will be the medium term impact of Pakistan's front-line status in the US war on terrorism on Pakistan's economy. Some observers have assessed that the immediate and short-term impact would vary between $1.5 billion to $2.5 billion during the current financial year. 26 This is in addition to the non quantified adverse impact on foreign investment and also the national output.

Pakistan's economy thus faces problems which have a potential to affect the macroeconomic framework of the nation. The “available data point to a deterioration of the real economy. In the period July-October 2000, sluggish export growth of 1.9 per cent US dollar terms, compared with the same period a year earlier reflects a slowdown in the world demand, as well as significant rise in freight and insurance costs. Imports dropped by 9.9 per cent (in US dollar terms) compared to the year earlier period.” 27

Positive Moves for the Economy Post-September 11

After Pakistan's support to the United States war against terrorism some of the economic aid suspended earlier was resumed. Not only are the US and other nations offering economic benefits but also financial institutions like the International Monetary Fund and the World Bank and the Asian Development Bank are coming up with financial support packages to Pakistan.

Table 4. Economic Packages for Pakistan

| Agency/Country | Amount Assured/Committed | Remarks |

|---|---|---|

| World Bank | $300 million | The loan is to help privatise and restructrue the banking structure. The loan was on schedule for lending to Pakistan before the September 11 attacks in the USA. Also, dialogue for some additional funds is on between the two parties, figures for which are not disclosed. |

| International Monetary Fund | Special Drawing Rights (SDR) 1.034 billion (about $1.322 billion) |

The Executive Board of IMF has approved a three year arrangements for Pakistan under the PRGF, totaling Special Drawing Right (SDR) 1.034 billion (about US$1.322 billion). As a result of this decision by IMF Pakistan will be able to draw SDR 86.16 million (about US$109.6 million) under the arrangement. |

| Asian Development Bank | $950 million (for the year ending December 31, 2001) | This is a substantial rise from $626 million planned before the events of September 11. |

| United States of America | US $1 billion (approx) | Two installments of $50 million in grant have been released. The US has already rescheduled Pakistan's repayment of $379 million for the year 2001. In terms of direct assistance there is $95 million in ongoing programmes of assistance, in democracy, education, heath, child labour elimination and counter-narcotics. The US will also provide $30 million in food assistance over the next year and $73 million for border security and law enforcement programme. In addition to all this, there is the Export-Import Bank (EXIM) money, as much as $400 million, and Overseas Private Investment Council (OPIC) money as well, of $200 million. |

| Japan | — | Rescheduled repayment of their dues of US$550 million. |

| Canada | — | Rescheduled repayments of their dues of US$238 million. Also, $300 million loan has been converted into a development funding. |

| Britain | $152 million | It is a three year loan. |

| United Arab Emirates | $265 million | Financial assistance is for four different hydropower projects. |

“Transcript of a Press Briefing by Thomas C. Dawson, Director, External Relations Dept,” IMF, November 1, 2001, Washington, DC, at http://www.imf.org/external/np/tr/2001/tr011101.htm

“IMF Executive Board Approves US$1.3 billion PRGF Credit to Pakistan”, Press Release No. 01/51, December 7, 2001, International Monetary Fund, Washington, DC, at, http://www.imf.org/external/np/sec/pr/2001/pr0151.htm

“ADB raises aid to $950 million,” The News International, at http://www.jang.com.pk/the news/nov 2001-daily/06-11-2001/main/main5.htm.

S. Rajagopalan, West going all out with its bonanza for Pakistan, Hindustan Times, New Delhi, 25 October 2001.

News (1/11), as cited in, POT, Pakistan Series. November 5, 2001, XXIX (261) 4765. “Daily Press Briefings, Richard Boucher, Spokesperson, Washington, DC,” at, http://www.state.gov/r/pa/prs/dpd/2001/

Dawn (4/11), as cited in, POT, Pakistan Series, November 7, 2001, XXIX (.263) 4816.

Pakistan certainly feels relieved after the lifting of the US sanctions. This development has enabled the World Bank to resume its aid programme to Pakistan. In fact, the the World Bank has sent a strong message that it wants to promote positive reforms within Pakistan. Also, dialogue for some additional funds is on between the two parties, figures for which are not disclosed.

The package of the ADB and other multilateral agencies was on the cards even before September 11, but the size and the conditions attached to the bailout packages would decide whether the nation is gaining in real terms or is just adding to its debt burden.

Simultaneously, the Paris Club 28 creditors agreed on December 13, 2001 to a request of Pakistan to restructure its public external debt. “The agreement provides for a comprehensive restructuring of a stock of debt amounting to US$12.5 billion as of November 30, 2001. The restucturing is conducted according to the following terms: Commercial credits are to be repaid over 23 years, with five years of grace and progressive payment, at the appropriate market rate; Official Developments Assistance credits are to be repaid over 38 years, with 15 years of grace at an interest rate at least as favourable as the concessional rates applying to those loans”. 29

The Paris Club deal enabled Pakistan to negotiate bilaterally with each of the creditor countries. However, it must be noted that the Paris Club agreement just provides an umbrella agreement for Pakistan which would have to reach an agreement along these lines with the individual creditor countries on a bilateral basis.

Looking at the benefits on the trade side, the European Union has offered Pakistan wider access to its markets. All tariffs imposed on exports of Pakistani clothing will be removed from January 2001. Secondly, the EU quota for imports of Pakistani textiles and clothing will be increased by 15 per cent on a one-off basis across the board. 30 Pakistan is expected to reap rich benefits out of these trade concessions. Pakistani daily viewed this as a very positive move and as the best possible access to the EU. The EU is expected to sign a new and more favourable trade agreement with Pakistan. 31 There is hope in Pakistan that the US would offer similar access to it's market.

Weighing the benefits for Pakistan Economy in real terms

Pakistan is definitely suffering from the economic fallout of the US war on terrorism. A highly indebted nation which had been struggling to get out of woods is facing additional problems of high costs of imports, slowing down of exports, imposition of war risk insurance and above all cancellation of export orders in the middle of the buying season.

Pakistan's Commerce Minister, Adbul Razak Dawood, expressed his apprehension, that the economy may face a loss of one to one and a half billion dollars on account of export earnings which would aggravate the trade imbalance. 32 The economy needs both immediate and long-term relief.

Pakistan is seeking debt write-off for bilateral loans and there are expectations that the country's help to the international alliance against terrorism will bear fruit in the coming weeks. The $37.1 billion debt which the economy carries on its shoulders is a disturbing figure. It includes $12.5 billion of bilateral debt (including $5 billion owed to Japan, $3 billion to the USA, $1 billion each to France and Germany and 738 million to South Korea) 33 Multilateral loans cannot be written off easily. Pakistan seems to be aiming at bilateral loans being written off. Nation rightly remarked that the only feasible long term economic solution is a write-off. It would provide the government fiscal space and the State Bank the balance-of-payments space. 34

Debt is a pressing issue in the Pakistan economy and thus the nation is aiming at a partial if not the complete write-off of debts. But so far Pakistan has not received significant positive signals in this direction. Rather, the request for write-off has given place to rescheduling of debt. Most of the money Pakistan is receiving is in the form of fresh loans which might be useful now but would only add to the debt burden of Pakistan in the long run. Infusion of loan money would certainly ease the situation but it is just temporary relief for the economy and not a cure and will only provide a breathing space to the economy.

Nation reported that Japan has declined write-offs citing legal constraints and has offered rescheduling of debt and the aid package offered by the US also misses out on debt write-off requested by Islamabad. The US has spoken of debt relief which might mean a mix of write-offs, reschedulings, renegotiations of terms of repayment and servicing. 35

Although Pakistan has received assurances for millions of dollars of economic assistance from the international community, it is unfortunately not very close to attaining closure on most of these assurances. The Pakistan economy, which is in the grip of a massive debt trap, and has faced a blow to its trade front for being the front line state in the war against terrorism, needs significant immediate inflows which do not seem to be forthcoming. Dr Asad Sayeed, an economist said, “We need aid-at least 5 billion dollars that is free of conditionalities so that we have some fiscal space”. 36

Economic sanctions have been lifted by the US and other countries i.e., Canada and Japan and it will result in resumption of economic assistance by the bilateral governments but the economists in Pakistan view it as just a “red herring with little significance either way, they may have aggravated Pakistan's problems, they were never the cause nor are they the solution”. 37 According to Akbar Zaidi, an economist, there is not going to be much of an economic revival of the kind the government is hoping for. He further adds, “It will get this buffer, perhaps some money from the IMF or some aid from the US but that is just to roll over the government's problems”. 38

It is estimated that the government may have to suffer revenue shortfall due to the recessionary trend in the economy and falling imports. This would eventually result in the increase in the budget deficit which will have to be controlled through creation of additional resources and pruning unproductive expenditure. Thus, the worsening of the budget deficit and balance of payments deficit are the challenges threatening macro-economic stability of the nation. 39

The annual report of the State Bank of Pakistan (SBP), which was released in 2001, post-September 11, has given an assessment about the immediate and medium term prospects of the country's economy. The report presents both the negative and the positive side of the future prospects of the economy. The report is of the view that Pakistan's decision to support the US-led coalition and its frontline status have significantly enhanced the country's vulnerabilities to additional risks and costs. Referring to the positive side, the SBP said “In the external sector, the two noteworthy outcomes were: (1) for the first time in history, Pakistan was able to post a current account surplus of $331 million, and (2) the rupee-dollar parity depreciated by 18.6 per cent, the largest adjustment since 1982 when the rupee was moved to a managed afloat” 40

Referring to the country's vulnerabilities, the SBP further added, “In the short run number of factors will come into play:

Increase in freight rates and the imposition of war risk insurance will increase the costs of imports and make Pakistani exports more expensive.

Cancellation of air cargo flights by foreign airlines will disrupt trade flows.

Manufacturing units will have to maintain higher inventories.

The possible departure of expatriates from the country and the suspension of visits by foreign buyers (in view of the media hype about Pakistan being a war zone) will not allow the country to maintain normal trade relationships.” 41

The report further estimates that, “revenue collection will also suffer due to lower imports, while the continuous influx of Afghan refugees will put further pressure on Pakistan's limited resources and infrastructure” 42

Trend Analysis

Pakistan's coalition with US in the war against terrorism has brought the Pakistan economy both losses and benefits. It's economy has suffered losses due to declining exports and flow of foreign investment. This also gets reflected in the behaviour of stock market and inflow foreign exchange through foreign exchange accounts. This can be seen from the graphs below:

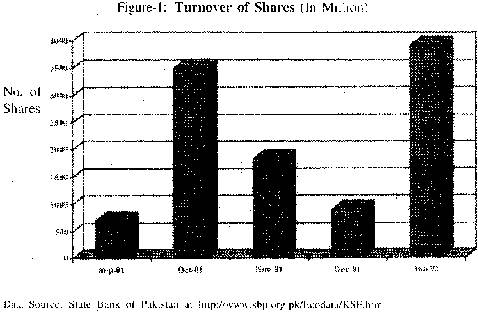

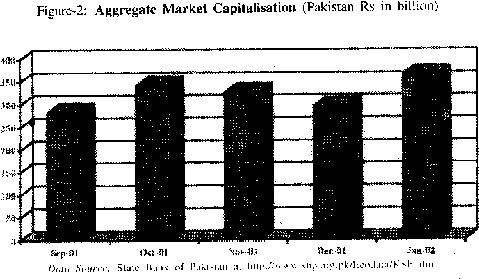

Figure 1 suggests turnover of shares in the Karanchi Stock Exchange. The turnover can be seen going up in October as the Operation Enduring Freedom was launched on 7 October 2001 and everyone was downloading their shares. By December 2001, the downloading of shares came down substantially as the major portion of the war ended. With the Paris Club debt rescheduling announcement, the share market became active in January 2001. This is also reflected in market capitalisation as seen in Figure 2. In January 2001, after the Paris Club rescheduling of debt took place on December 13, 2001 and the war has come to an end the figure for the turnover of shares increased to a significant level of 3924.21 million.

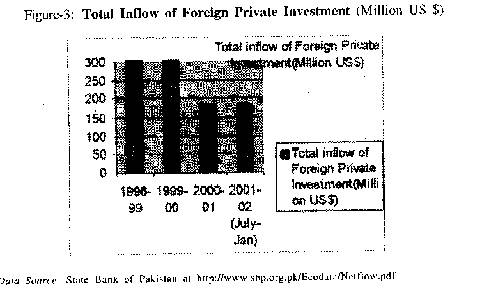

Figure 3 indicates that the inflow of foreign investments went down substantially in Pakistan after the military takeover in 1999. Thus the figures of 2000-2001 indicate a decrease from $543.4 million in the year 1999-2000 to a ridiculously low level of $182.0 million. Then in the period of July 2001-January 2002, the figure has remained more or less the same and it is unlikely to go up substantially despite a number of economic incentives announced to Pakistan from the international community. This could be attributed to the domestic unrest and violence in the country.

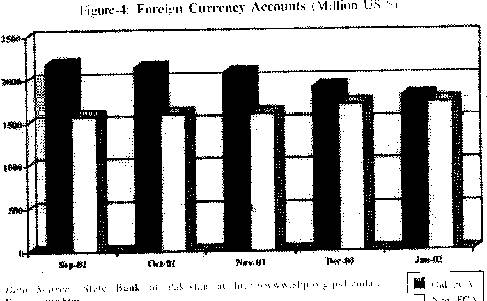

Figure 4 shows a decline in the foreign currency account in the period of September 2001-January 2002. The decline was due to the fear of war and uncertain environment in the nation. But we see a gradual increase in the new foreign currency account. A relatively significant increase can be witnessed in the period of December 2001 to January 2002, after the major operations of the war ended. This development can be attributed to the crackdown on Hawala. 43

Thus the negative shades of the September 11, terrorist attack can be seen on Pakistan economy in the period Sept-Dec 2001. But the positive shades can be seen in the month of January 2002 with the end of war.

The negative impact of war on the economy will take a time to reverse but it cannot be denied that Pakistan has a window of opportunity. The positive side of the war shows the resumed aid, credit flow, loan rescheduling and greater market access being offered to Pakistan. However, the incoming financial assistance would only provide short-term relief to the economy and in the long run would add to the debt burden of the country. But for the time being Pakistan would have access to the money and market and the situation does provide an opportunity to Pakistan to revitalise its export sector and explore new markets which might boost industrial and agricultural production.

Thus, it remains to be seen whether the Pakistan economy is able to exploit the opportunity created by the current inflow of international financial assistance by changing its economic strategy and overcoming the domestic unrest. Otherwise, the negative effects of the war will outweigh the positive effects and leave Pakistan's economy in a much worse position than it was prior to September 11, 2001.

Acknowledgements

I am thankful to Shri T. Sreedhara Rao for all his suggestions and advice, which helped me in shaping my paper.

Endnotes

Note *: Shalini Chawla is a Research Officer at IDSA. She joined the institute in December 1999. She finished her M.Phil from School of International Studies, Jawaharlal Nehru University and is currently pursuing her doctoral studies. Her research area is Pakistan, and her publications have been focussing on Pakistan military and economic issues. Back.

Note 1: Ghulam M.Haniff, “Can Pakistan's Economic Collapse be Averted?”, Pakistan Link, internet site, http://www.pakistanlink.com/Opinion/2001/May/25/01.html Back.

Note 3: See, Shabbir H. Kazmi, The State of Pakistan's Economy, Pakistan and Gulf Economist, June 11-17, 2001, p. 30. Back.

Note 4: Pakistan Economic Survey 2000-2001, at, http://www.finance.gov.pk/survey Back.

Note 5: For details see, News (26/9) as cited in, Public Opinion Trends Analyses and News Service (POT) Pakistan Series, September 28, 2001, XXIX (230), 4078. Back.

Note 6: News (26/9) as cited in, POT, Pakistan Series, September 28, 2001, XXIX (230), 4077-78. Back.

Note 9: Pakistan Economic Survey 2000-2001, no. 4. Back.

Note 10: State Bank of Pakistan Annual Report 2000-2001, at, www.sbp.org.pk/report2001/Chap1.pdf Back.

Note 11: Pakistan Economic Survey 2000-2001, no. 4. Back.

Note 12: For details see, Parvez Hasan, Pakistan's Economy at the Crossroads Past Policies and Present Imperatives, Oxford University Press, Karachi, 1998. Back.

Note 13: Nation (29/9) as cited in, POT, Pakistan Series, October 3, 2001, XXIX (233) 4143. Back.

Note 14: “America's Post-War Obligations”, Pakistan Link, at, http://www.pakistanlink.com/Editorial/10122001.html. Back.

Note 15: Dawn reported that the Special Cell in the Export Promotion Bureau “received reports of cancellation of 14 million dollars worth of supply orders from 29 exporters”. It was reported that the buyers from US, Europe and South Africa cancelled 20 orders, 7 orders and 1 order respectively. Back.

Note 16: External trade in disarray, Dawn, 11 October, 2001. Back.

Note 19: Nation 29/9 as cited in, POT, Pakistan Series, October 3, 2001, XXIX (233) 4144. Back.

Note 20: Besides Pakistan, the countries hit include Lebanon, Syria, Israel, Egypt entire Red Sea, North and South Yemen and Oman. Back.

Note 21: News (19/10) as cited in, POT, Pakistan Series, October 25, 2001, XXIX (252) 4561. Back.

Note 22: Bad time for travel, Dawn, Internet site, http://www.dawm.com/2001/11/10/edhtm. Dawn, also noted that Peshawer, Quetta and Islamabad were the three cities where hotels were reportedly doing well, and this was due to a large number of foreign journalists who were keen to get close to the war zone. Back.

Note 24: News (18/10) as cited in, POT, Pakistan Series, October 22, 2001, XXIX (249) 4498. Back.

Note 26: Dawn (23/8) as cited in, POT, Pakistan Series, October 30, 2001, XXIX (256) 4651. Back.

Note 27: “IMF Executive Board Approves US$1.3 Billion PRGF Credit to Pakistan”, Press Release No. 01/51, December 7, 2001, International Monetary Fund, Washington, D.C., http://www.imf.org/external/np/sec/pr/2001/pr0151.htm. Back.

Note 28: Paris Club is an informal group of official creditors whose role is to find co-ordinated solutions to the problems faced by the debtor countries in terms of making the payments. This group agrees to rescheudle the debts due to them. Back.

Note 29: “Debt stock restructuring agreement between the Paris Club and Pakistan”, Paris Club news, December 13, 2001, http://www.clubdeparis.org/en/news/page_detail_news.php Back.

Note 30: Dawn (19/10), as cited in, POT, Pakistan Series, October 25, 2001, XXIX (252) 4561. Back.

Note 32: News (2/10) as cited in, POT, Pakistan Series, October 8, 2001, XXIX (237) 4227. Back.

Note 33: Nation (23/10) as cited in, POT, Pakistan Series, October 30, 2001, XXIX (256) 4652. Back.

Note 36: Sanna Ahmed, More Carrots, less stick, The Herald, October 2001, 36a. Back.

Note 38: Ibid., 36a-36b. Back.

Note 39: News (2/10) as cited in, POT, Pakistan Series, October 8, 2001, XXIX (237) 4228. Back.

Note 40: State Bank of Pakistan Annual Report 2000-2001, www.sbp.org.pk/report2001/chap1.pdf Back.

Note 43: Hawala is an illegal mode of transmitting money from one place to another without following banking channels. It has come under scrutiny by law enforcement agencies, post September 11, 2001. Back.