|

|

|

|

CIAO DATE: 6/00

Beyond the Basle Accord: Banking Regulation in a System of Multilevel Governance

International Studies Association

41st Annual Convention

Los Angeles, CA

March 14-18, 2000

Abstract

In the 1980s, international banking regulation was thought to exemplify a case of successful regime development. Negotiations at the international level produced a multilateral agreement that established a uniform standard of capital adequacy to safeguard against financial risks. In the following decade, however, a multilevel-model of regulation evolved that accorded greater significance to the cooperation between private and public actors and to the interplay between the international and national levels. In this article, I shall examine the reasons for the transition from the first model to the second. I will argue that the choice of any regulatory approach depends on the conflict situation at hand in which those responsible for regulation find themselves because of the nature of the problem that needs to be solved. Whereas in the 1980s, the problem was a conflict over distribution, which could be resolved through multilateral negotiation, actors today are confronted with more complex forms of financial risk resembling a ‚‘game against nature’, so to speak . In order to regulate these, actors have replaced negotiation by communication-based learning processes.

In finance, the risk-taking of a single market actor can trigger a chain reaction by spreading negative externalities on a worldwide scale. Since credit institutions function as a link between debtors and creditors on financial markets, banking failures not only hurt private investors but also cripple foreign enterprises in their capability to invest and to create new jobs. The systemic character of financial risks is exactly the normative reason why in banking, unlike in other branches of the economy, the management of economic risk is an issue concerning the state. Legalized duties to build up capital buffers for risk protection and sanctions in cases of rule violations are instruments to establish a regulatory safety net. Ultimately, the aim is to prevent situations in which the state and thereby its national central bank are forced to intervene as lender-of-last-resort, leaving the taxpayer burdened with the losses created by privately undertaken risks (see on financial regulation Kay/Vickers 1988; Herring/Litan 1995; Goodhart et al.1998).

The globalization of finance has eroded the capacity of nation-states to impose binding rules on their constituencies and to effectively monitor and enforce them. Market actors use their opportunities for broadening their sphere of activity to circumvent public policies that would impose regulatory costs on them. European banks for instance, used their ‘exit-options’ (Hirschman 1970) in the early 1970s to evade the creation of expensive capital reserves by building credit pyramides in less regulated markets abroad (OECD 1983: 109). Effective risk protection has obviously turned into a problem of collective action on the intergovernmental level.

So far, two different institutional arrangements can be identified that have compensated for the loss of domestic problem-solving capacity: in the 1980s, international banking regulation seemed to exemplify a case of successful regime development (see Krasner 1983 on the regime definition and Kapstein 1989, 1992, 1994; Genschel/Plümper 1997 on the case of banking). Multilateral cooperation aimed at expanding the scope of imposed regulation and thereby to deprive internationally operating banks of any exit-options. At the level of the ‘Basle Committee for Banking Supervision’ a coordinating body comprising of central bankers and regulatory agencies from the Group-of-Ten (G-10) countries and Switzerland, it was possible to produce a multilateral agreement that established a uniform standard of capital adequacy, at least within the circle of the Western industrial nations, to safeguard against financial risks (‘Basle Accord’).

In the following decade, there emerged a multilevel model of international banking regulation that can no longer be sufficiently explained by the categories of the regime approach. The new model accords greater significance to cooperation between public and private actors and to the interplay between international and national levels. The Basle Committee is no longer predominantly the platform for intergovernmental negotiations of binding equity standards, aimed first and foremost to eliminate exit-options of market actors. The former regime is transforming into a ‘transnational clearinghouse’ where information on the best practices of financial market regulation at the national level is compiled and distributed among the member countries. The new model aims at knowledge generation in a new, uncertain financial environment.

In this paper, I shall examine the reasons for the transition from the first model to the second. By applying categories of situation definition derived from game theory, 1 I argue that the choice of any regulatory model depends considerably on the conflict situation facing the players in light of the type of financial risks in need of regulation. Whereas in the 1980s, the problem was a conflict over distribution which could be resolved through multilateral negotiation, actors today are confronted with more complex forms of financial risks resembling a ‘game against nature’ so to speak. In order to regulate these, actors have replaced negotiation by communication-based learning processes.

The following three sections describe the empirical processes, starting with an explanation of how the earlier regime functioned (section 2), followed by an outline of changes in the international framework for regulatory activity (section 3) and of the transition to the new type of regulation (section 4). Section 5 highlights the structural patterns of institutional change and stylizes the features of the two regulatory models. Last of all, the implications for the theoretical debate are discussed (section 6). 2

In the 1970s, institutional measures to prevent possible financial crises were found to differ thoroughly when compared internationally. Whereas all national models of banking regulation shared the basic concept that banks should be required to build up capital reserves in order to cushion against financial risk, countries differed in the way this concept was put into practice. In the mid-1980s, two models represented the endpoints on the spectrum of regulation: On the one end was the more static or fixed-rate approach (‘gearing ratio’) long used in the United States, as well as in Canada and Japan. On the other end was the more flexible, risk-based approach implemented in Great Britain and many Continental countries (such as Germany, France, Switzerland, Belgium, Sweden, and the Netherlands).

The fixed-rate model prescribed banks to calculate their reserves based on a fixed capital-to-asset ratio of 5.5 percent. This meant that for every $100 in bank investments, American banks were required to put $5.50 in reserves, regardless of the actual risk involved in their business transactions. It did not matter whether bank funds were invested in ‘riskier’ loans to developing countries or to one’s own government. For the bank involved, reserves of this type always cost the same. In the United States, this rather crude and not very effective regulatory approach represented in actuality the lowest common denominator of the three federal administrative bodies responsible for banking regulation, each of which in the 1970s was still using a completely different method to calculate capital.

At the other end of the regulatory spectrum was the strategy implemented by countries like Germany and Great Britain as early as the 1960s and 1970s in which the level of required capital reserves was determined by the degree of risk involved in the business transaction. Very risky loans were ‘punished’ by being saddled requirements for larger reserves, while receivables that could be liquidated at short notice were ‘rewarded’ with lower percentages of required capital reserves. All the same, this risk-based regulatory approach was practiced in each country in a manner corresponding to its own historically evolved, regulatory culture. In Great Britain, for example, the capital ratios were set through informal agreement between representatives of the Bank of England and the managers of the individual banks, whereas in Germany the national regulatory authorities worked out a tradewide standard in cooperation with the banking associations (see Coleman 1996, on the various national political models and regulatory traditions in banking).

As a result of these historically evolved differences, internationally operating banks ultimately varied in the degree to which they were capitalized and insured against bankruptcy or financial loss incurred by payment defaults. As long as market regulations confined the banking business to the national level, different forms of regulating risk management could coexist without problem. This changed significantly in the 1970s as the lending business became increasingly internationalized. 3 If foreign debtors defaulted on their loans or an internationally operating bank went bankrupt, the consequences were not necessarily confined within national borders: From this point on, negative externalities became border-transcending phenomena more frequently. Bank failures caused by risky speculations in foreign exchange, such as the cases of the Herstatt Bank in West Germany and the Franklin National Bank in the United States, initially alerted national central banks and regulatory authorities to this new danger in which, for the first time, bank failures effected an extensive network of correspondent banks. However, it was not until the crisis of 1982 that the full extent of unsolved regulatory issues was revealed. 4

That same year, the Mexican foreign minister announced a payment moratorium and thus the inability of his country to repay any further interest obligations to foreign banks (Kapstein 1989 and 1992; Cooke 1990). This announcement aroused the fear abroad that the entire region of Latin America might not be sufficiently solvent. Therefore, no more loans were made by foreign banks in the eighteen months following the announcement of the payment moratorium. Since half of the bank debts in the Third World originated from non-US banks, the debt crisis developed into a problem of international scale. Memories of the Great Depression in the 1930s loomed large. Were internationally operating banks sufficiently solvent to withstand financial loss due to defaulted loans? If not, then it was to be feared that investors would lose their trust in the banking system and that international interdependencies between these banks would require a massive influx of financial support. Short-term crisis management stabilized the situation with the help of subsidies from the International Monetary Fund (IMF), 5 debt rescheduling, and bi- and multilateral agreements between industrial and developing countries. Following this crisis, interest grew everywhere in establishing a stronger safety net by way of an international regulatory agreement.

Representatives from the central banks commissioned the Basle Committee on Banking Supervision (Basle Committee) to investigate the current state of capitalization of internationally operating banks and to review the techniques used by each of the member states to calculate capital (capital adequacy). 6 The committee reported that the level of capital in international banks was dropping constantly. For example, the ratio of capital reserves to corresponding assets in American big banks had fallen to the historical postwar low of 4.5 percent and in French banks to only 2 percent. Finally, the committee’s work also elucidated to everyone the different techniques used by the member countries to calculate capital (Kapstein 1992: 275).

It made sense that the way out of this crisis for all concerned was to agree to a standardized method of measuring and securing against the risk involved in financial transactions (see also Cooke 1990 for a participant’s viewpoint). Nevertheless, competing ideas on exactly what this standard should be, prevented the various participants from coming to a quick agreement. Differences arising from national, historically evolved methods of calculating capital, or more specifically from the preference for more fixed-rate or more risk-based approaches, emerged and appeared to be irresolvable, despite the meticulous care given to detail by the various working groups of the Basle Committee. Against this backdrop of heterogeneous national traditions in regulation, those attending a Basle Committee meeting early in 1986 remained convinced that a quick agreement on a common standard to safeguard against risk was quite improbable (Reinicke 1995: 166).

What finally made it possible to resolve this conflict politically was a shift of preference by the United States, one of the largest banking markets and at the same time a proponent of one of the two extreme positions regarding risk management. When Continental Illinois, the country’s eighth largest bank, required a strong ‘fiscal shot in the arm’ from America’s central bank, the Federal Reserve Board of the United States (Fed) in 1984, the deficiencies of America’s own model of regulation became more than apparent. The Fed was determined to avoid giving its own banking community the impression that every credit institution would be saved, regardless how poor its management or how large the risk factors of its loan portfolio (Cohen 1986: 295). For the first time, a consensus grew among America’s three federal administrative bodies supervising banking 7 that the existing fixed-rate form of capital measurement needed to be replaced with a flexible approach in which capital reserves were required in proportion to the type of risk involved. 8 American banks claimed, however, that unilateral measures would impair the nation’s ability to compete against countries where the banks were undercapitalized, such as in Japan (Kapstein 1989: 339). A multilateral agreement within the Basle Committee on the common standard for capital adequacy would have evened the international playing field for American banks. However, diverging views on technical issues prevented anyone at the time from believing there was any immediate prospect for an agreement. Faced with such stalemate on the international level, the Fed began talks with the Bank of England in order to determine whether there was any chance for a bilateral understanding concerning procedures for calculating equity. Great Britain had already been using a risk-based approach for some time and shared with the United States many concepts regarding the definition of what constituted capital. In January 1987, the two countries announced a bilateral agreement on common standards of capital adequacy. Aspects of issues being fought out between members of the Basle Committee were resolved in this American-British agreement, including the definition of capital, a chart of the various types of credit and their importance with regard to risk, as well as stipulations on how much capital should be reserved to cover what type of risk (Kapstein 1989: 339). Outside of the United States and Great Britain, this two-page agreement was seen as a possible threat and as ‘political blackmail’ (Interview 980909). Would foreign banks only be allowed in the future to operate in the British and American markets if they accepted the bilateral standard? It is therefore not surprising that this ‘transatlantic deal’ (Financial Times) between the two countries with the world’s most important financial markets became the decisive means of exerting pressure, initially, to commit Japan, as the third largest financial market at the time, to a consensus and, lastly, to work out a common standard that would be acceptable to all committee members (Genschel/Plümper 1997: 630).

After nearly another full year of settling the technical details in the committee’s working groups, the committee members finally agreed in December 1987 upon a detailed method of categorizing risks and upon groups of equity components that could be used as risk collateral. In the eyes of participants, this method ‘combined purity with pragmatism’ (Cooke 1990: 330) and represented a fair compromise between the more restrictive German position and that of the Anglo-Saxon countries. In the end, the ‘Basle Accord’ surpassed the bilateral agreement and was considered, not without reason, to be the greatest success in regime history to that point. In fact, the agreement could be judged as a ‘club rule’ among OECD countries since bank loans made to counterparties in OECD member countries required lower capital cushions than loans given to the non-OECD-area (White 1999: 7).

The implementation of this standard on the national level went just as smoothly. From the view of the participating members, such a collective solution proved to be ‘autonomy-safe’ (Scharpf 1994), because national regulation practices could still be continued in the shadow of a quantitative minimum norm. In Great Britain, for example, the new capital ratio was set as always between the Bank of England and individual banks, whereas in Germany, supervisory agencies and leading banking associations determined a norm for the entire banking sector in a corporatist manner. In this case, countries were pressured very little to converge their national, historically evolved cultures of regulation. However, market mechanisms did begin to play a more influential role in spreading the application of the standard: Rating-firms also began to take into consideration the ‘capital adequacy’ of internationally operating banks when evaluating the banks’ solvency. Depending on the result of such evaluations, the costs for loans between international banks could be raised considerably. The hope of gaining a competitive edge by conforming to higher security standards finally convinced credit institutions in countries outside the circle of the Basle member states (among them Australia, Finland, Norway, Portugal, Spain) to adopt the new norm (Genschel/Plümper 1997: 630, 637).

The 1980s are considered to be the decade in which financial markets entered the phase of actual globalization. The development that began in the 1960s toward expanding the territorial scope of banking activity profited from the retraction of business regulations and capital exchange controls and from advances in computer technology. However, true globalization has been characterized not simply by the territorial expansion of economic activity but, more importantly, by structural changes within international markets, combined with the emergence of qualitatively new forms of financing.

Three broad developments characterize these structural shifts: first, an increasing share of financial intermediation is taking place through capital markets as opposed to bank lending. Banks, as the classical financial intermediaries, are increasingly bypassed by credit-worthy borrowers who prefer to transform their liabilities into tradeable securities since this seems to be a cheaper way of raising capital than relying on bank credits (securitization).

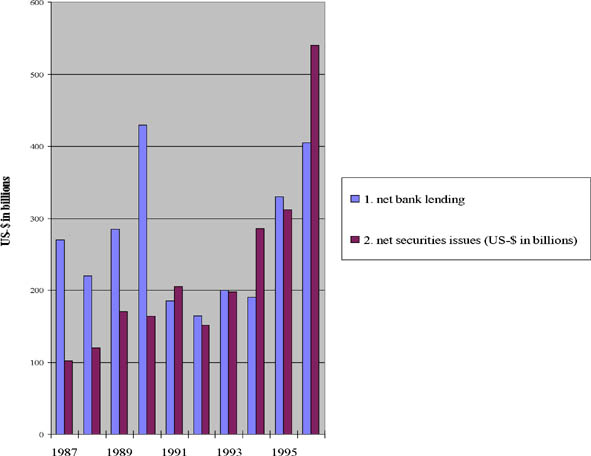

Beginning in the mid-1980s, the predominance of international lending over the issuance of securities began to falter. Only in 1993, however, did the securities business really began to rise clearly and steadily; by 1996 its share of the banking business surpassed that of lending by more than US $100 billion. With declining loan business, commercial banks expand into more profitable lines of business such as investment banking where profits are made through brokerage comissions instead of interests on credits.

Second, institutional investors have become the major players on globalized securities markets. During the last fifteen years, insurance companies, pension funds or mutual funds have experienced a considerable growth and play an ever-increasing role as collectors of savings, major owners of publicly held companies, and investors in securities and other financial assets. 9 The power of institutional investors is based on the fact that they are operating with large blocks of the most liquid shares and that they diversify their investment worldwide among the most profitable countries, regions and economic sectors.

Third, the last decade has witnessed a rapid rise of foreign exchange trading and of new financial products, so called ‘derivatives’ which allow either to hedge the risk of exchange- or interest rate fluctuations or to exploit them for speculative purposes.

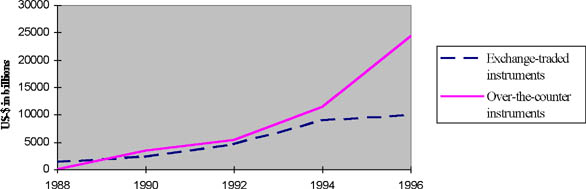

The increasing attractiveness of the derivative business is reflected in its explosive growth since the end of the 1980s. Whereas derivatives were traded on international stock exchanges in 1988 for a nominal value of US-$1.3 billion, this figure had risen sevenfold to US-$9.9 billion by 1996. The bulk of the derivative business, however, does not take place on the stock exchanges but within international networks of traders representing banks, specialized brokerage firms, or even economic enterprises. Statistics calculated by the Bank for International Settlements show that for 1996, off-the-board trading in derivatives equaled a nominal value of US-$24.3 billion. What makes the derivative business so attractive compared with the customary securities trade is that contracts are closed today but carried out at a specified later date. At the time the contract is signed, only a small percentage of the full price is paid as security. Without much financial input, loan debtors and investors are now in a position to exchange capital in the form of financial commodities that are tailored to their individual needs, have high liquidity and are therefore tradable. Most important, this new so-called ‘off-balance-sheet business’ enables banks in principle to lower their exposures and therefore also their equity cushions, depending on how ‘creatively’ these financial instruments are being used (White 1999: 9).

In terms of banking regulation two aspects are of crucial importance: first, compared with the 1980s, the group of possible ‘risk takers’ has widened. Banks, but also brokerage firms, securities houses, issuers of equities as well as institutional investors have to deal with issues of risk management, also because larger parts of the worldwide capital flows are of private character. One among other factors that had triggered the outbreak of the Asian crisis, for instance, were huge amounts of private, short-term investments in the Asian countries which were quickly withdrawn by institutional investors leading to ‘herding effects’.

Second, new types of financial risks are emerging that differ from those of the customary lending business. Whereas the risk involved in the classic lending transaction lies in the conditions of credit stipulated in the transaction itself, 10 such as the possibility that the debtor fails to repay the loan or violates the contractual stipulations, new forms of risks are linked to changes in exchange rates or interest rates and are thus dependent exclusively on the volatility of the market (see Bank for International Settlements 1986, Rotberg 1992). Moreover, correlations between various risk types evolve, since a bank usually trades in various equities and in different trading places at the same time. In derivative trading, large amounts of earnings and risks are positioned with little or no capital leading to leverage effects in all transactions. The variation in the control parameters of the market (volatility, correlations) makes risk management from this point on a complex task.

Recent cases of failure like the collapse of the German DG Bank in 1990 or of the highly respected British Bank Barings in 1995, both of them due to blundered speculation in derivatives, revealed that unauthorized trading activities of single employees over a period of years might lead to titanic losses when the market takes an unexpected turn. In the case of Barings‘, the English central bank itself came under fire for lapses in its supervisory practices (Rawnsley 1995: 228-235). At the onset of the Asian crisis, actors also tended to underestimate the different risks of their investments: European banks built up large credit exposures in South-East Asia or lent money, in a situation of speculative bubbles, to finance risky real estate projects (Artopoeus 1998: 2). Partly, because short-term bank loans to OECD member countries required low capital cushions from banks (‘club rule’), countries like Korea attracted more short-term capital than was healthy since the money was suddenly withdrawn (White 1999: 8). Also, rating agencies obviously overestimated the solvency of private and sovereign debtors, thereby sending false signals to investors. Deficiencies in private risk management added up with those in supervisory practices, but also with other policy failures like pegged exchange rate policies. Together, these factors gave rise to a chain reaction of devaluation, falling share prices and in the end, bankruptcies also in the banking sector.

Regulators who have to tackle the problem of financial risks in one way or another find themselves in a more complex situation than in the 1980s. Today, multilateral agreements that remove ‘exit-options’ of market actors by widening the territorial range of national regulations seem no longer the feasible institutional solution to the problem of risk management. New financial instruments allow to exchange capital in forms that are tailored to the specific needs of debtors and investors and are tradeable on the market. The risks evolving out of these more anonymous, short-term and individualized financial transactions are closely linked with market parameters and therefore differ qualitatively from old, more ‘relational’ since credit-based risk types. Given an obvious ‘loss of linear relations’ (Goebbel 1995: 65), risk management techniques that aim to ‘take a snapshot’ of the risk structure of transactions for set dates appear no longer adequate. Since the individual risk portfolio can alter within hours and erode the capital equity base within a very short time, negotiated equity standards become more and more ‘hollowed out’. Regulators have instead to look for institutional solutions that address the growing complexity of financial markets better.

Since the beginning of the 1990s, a more flexible and qualitatively oriented model of international banking regulation is emerging that accords greater significance first, to the collaboration of public and private actors in questions of risk management and second, to the interplay between international and domestic levels.

To begin with, public-private collaboration reflects efforts of global banks to create their own self-regulatory bodies and then urge the governmental regulatory community to intensify the use of such ‘self-regulation’ in risk management. Organizations like the Group of Thirty (G30) and the Institute of International Finance (IIF) are self-help organizations for the banking business-the former organized as a study group of high-ranking representatives from the banking business, the later as a Washington-based think tank. The IIF was established in the early 1980s, during the debt crisis, to act as a type of early warning system by supplying banks with better information and risk analysis. In April 1998, more than 280 banks operating worldwide from 50 countries were represented in the IIF (Frankfurter Allgemeine Zeitung, 17 April 1998: 16). 11 Both organizations observe the market and agree, with increasing frequency, on desirable, self-imposed restrictions concerning risk management and accounting standards. The growing involvement on the part of the banks culminated in a move by the G-30 in June 1997, to transfer responsibilities in banking regulation to a ‘standing committee’ made up of representatives from the most important global players and several supervisory authorities. The purpose of the committee would be to work out fundamental principles for an effective risk management (Group of Thirty 1997; Financial Times, 6 June 1997: 7). 12

Against the backdrop of this increasing institutionalization of private self-help organizations on the global level, it is not surprising that the representatives of both organizations were also the ones to introduce into the debate the decisive elements of a new, rather qualitative and flexible approach of risk regulation in 1994: Banks themselves should have the chance to calculate the capital adequacy ratio for derivative transactions based on their own computer models. The application of bank models would promise to create capital requirements tailored to each bank’s own loan portfolio and thereby save overall on capital reserves (Financial Times, 7 July 1994). It was no accident that this impulse came primarily from American banks such as J.P.Morgan and Chase Manhattan, which have long been active in securities trade and possess the corresponding expertise also with internal systems of risk measurement. Therefore, they expected to enjoy an international competitive edge if such models were quickly introduced (see also Hartmann 1996).

In general, the committee has still blocked all too blatant attempts to instrumentalize this involvement on behalf of banking interests. The Basle authorities have been adamant in their refusal to hold their meetings together with bodies of banking representatives, preferring instead to maintain contact to the various lobby groups. They reject the idea of letting banks regulate themselves exclusively, for such a move would mean the booting of the Basle Committee and its entire regulatory system (Handelsblatt, 20 October 1997: 27). On the other hand, the Basle Committee welcomes the growing involvement of the banks as an important step in expanding the general technical knowledge on regulative issues. Recent crisis situations have shown that the old standardized approach used to that point was thought to be too crude to factor in the risks which are linked to new financial instruments based on market fluctuations. Moreover, the Asian crisis revealed that the debtor categories of the Basle Accord (‘club rule’) were too broad and did no longer help to separate more ‘risky’ countries from safer ‘investment havens’. In fact, the Accord imposed ‘perverse incentives’ on banks by stimulating them to engage in short-term, but risky lending for reasons of lower capital requirements (Financial Times, 7 April 1999: 7). Thus, in the view of governments, there was also a need to look for ‘safer’ standards of capital adequacy; however this task was too great to handle without help because governments alone cannot generate the degree of technical knowledge required.

The solution to this dilemma was for regulators to give in to the banks‘ interest in flexible regulatory techniques while at the same time ensuring that states would still keep a hand on what the banks were doing. The Basle supervisors agreed to privatize the task of risk measurement, but insisted to reserve the final decision on the level of capital reserves required to adequately protect against financial risks for the community of states alone (according to Andrew Crocket, the chairman of the Bank for International Settlements in 1997; see Crockett 1997). In January 1996, the ‘in-house approach’ was expanded to include minimum requirements pertaining to the forecast power of models and to contain other additional stipulations: For example, banks were asked to multiply their (daily) self-calculated capital ratios by the factor three. A further penalty would be leveled should it become clear in hindsight that the model used by the bank failed to accurately forecast the realities of the risk portfolio (Basle Committee 1996). The impetus to introduce these stipulations, which were strongly criticized by the banks, came from the results of tests run by fifteen internationally operating banks that examined their risk portfolios from approximately 350 different positions with the help of their own models and ended up with widely differing capital-to-asset ratios (Basle Committee 1995). ‘If we had the right model ourselves, we would have imposed it,’ conceded the former chairman of the Basle Committee, Padoa-Schioppa (Financial Times, 13 April 1995: 22).

The ‘in-house approach’ for measuring risks related to derivatives trading was only the first step of a process to revise the Basle Accord incrementally. In June 1999, Basle launched a new consultation paper to extend this flexible approach to all sorts of credit risks which had been covered by the former standardized approach (Basle Committee 1999). The new regulatory framework which is supposed to finally replace the former Accord after a broader consultation and test phase in 2002, consists of quantitative as well as qualitative regulatory pillars. For the quantitative part, the new approach aims to better align capital charges to underlying risks by allowing banks to differentiate risk weights according to assessments of rating agencies or own ratings. It is intended that banks should have a closer look at the risks of credits to different groups of debtors since risk weights for credits to high quality corporate clients will be reduced while low quality exposures will require higher equity cushions. The objective is to impose incentives on banks to keep a permanent eye on their risk portfolio and on risk management in general.

Given the greater amount of flexibility for market actors within the regulatory framework, it is important to ensure that the bank’s capital position is consistent with its overall risk profile. It is for this reason that permanent oversight by the domestic regulatory bodies becomes a crucial point and that the ‘supervisory review process’ is the second pillar of the new regulatory framework. The state acts as a ‘technical inspector’ that periodically tests the forecast power of the banks’ own mathematical models or their risk assessments based on ratings. Should such ‘backtesting’ continue to reveal a poor ability of the bank to forecast risk, a ‘penalty’ is placed on the way in which the bank’s own model is rejected or the bank is required to hold capital in excess of minimum regulatory capital ratios. Furthermore, the new framework stresses the importance of a clear-cut distribution of responsibility for risk management within each bank as well as the task of the bank‘s management to develop an internal capital and risk assessment process. Governmental authorities then have to ‘evaluate the self-evaluation of the banks’. In fact, market players contend that they ‘know better than the state’ what it takes to handle risk. However, the first experiences with backtesting of mathematical models in Germany so far indicate that the supposed informational edge enjoyed by banks is not as overwhelming as expected: Not one of the tested models can be considered ‘perfect’.From the state's viewpoint, the most important progress so far has been the ‘educationally valuable incentive to continue development’ of risk management within banks (Interview 980909).

This flexible and interactive approach to banking regulation is nothing new for countries such as the United States and Great Britain that already possess a regulatory culture with ‘on-site’ inspections of banks and flexible, individually tailored solutions based on ratings. But for Germany, this approach is a break with the national tradition of treating all banks equally through universally applied rules and regulations and of a banking supervision monopolized by lawyers. In order to be able to keep up with the specialists in modeling and measurement from the banking business, the German Federal Banking Supervisory Office created a new department employing statisticians and economists and now trains the supervisory personnel who work at the head offices of the major banks in Germany. Since January 1998, veterans from the Supervisory Office, the German Central Bank, and the various provincial central banks have been visiting commercial banks in three-person teams and examine also the channels of information and the organization of responsibilities within each bank’s risk management. Over the medium term, pressure will grow on the member states of the Basle Committee to converge their regulatory practices. Whereas the Basle Accord was seen to be autonomy-safe since quantitative standards could easily be implemented in different regulatory cultures, the new model requires interactivity and flexibility in the daily regulatory business. However, against the background of the growing complexity and volatility of risk structures, this is probably the only possible regulatory solution at this moment.

On the international level, the task will be to gather, increasingly and continually, information on the ‘best practices’ of regulation in each country and to make these available to all member states, in order to push the process of standardization incrementally forward. Harmonization of rules however, is no longer a process of negotiating predeterminded preferences of states, but relies more than ever on domestic inputs. This new division of labor between the national and international level will influence primarily the relationship between the Basle Committee and the various national supervisory authorities (Basle Committee 1998; Padoa-Schioppa 1997). 13 Instead of acting as a platform for negotiations, Basle is developing instead into somewhat of a transnational clearinghouse for domestic inputs which are then brought in to continuing processes of harmonization on the international level. Im March 1998, the Committe has founded an ‘Institute for Financial Stability’ which offers both basic and advanced training to national supervisory personnel. 14 The Committee is also member of the ‘Forum of Financial Stability’, founded by the former German central bank governor Hans Tiedtmeyer, on behalf of the Group of Seven, in February 1999. The forum is conceptualized as a roundtable on issues of financial stability which represents domestic supervisory authorities (including some countries beyond the ‘G7 club of states’) as well as international organizations dealing with different aspects of stabilizing the financial system (IMF, Worldbank, BIS, OECD, but also the Basle Committee, IOSCO and IAIS as international regulatory bodies in the banking, securities and insurance sectors) (see Financial Stability Forum 1999).

During the 1980s and the 1990s, international institutions of banking regulation were restructured. It is now very clear that the regulatory model in which governments negotiated self-binding security standards has been replaced by a multilevel one in which technical knowledge and financial expertise are generated through close cooperation between the state and the banks on both the international and national levels. What facilitated this transition? It is argued that actors react to different strategic situations that arise from the various types of financial risk by choosing different methods to handle risk. The nature of the problem at hand determines the nature of the collective dilemma and, in turn, specifies the institutional mechanisms available to the actors to solve the problem. 15

In the first phase of internationalizing the world of finance, the primary goal was to protect against credit risks, such as the failure of foreign debtors to repay their loans. Risks of this type were considered to be ‘fairly stable’, because the behavior of the debtor can usually be observed over a longer period, thereby allowing a lender to learn from experience just how probable it is that certain types of debtors will default on their loans (Taylor 1996). This is a strategy to deal with uncertainty, in which it is assumed that a probability of outcome for a group of possible events can be calculated or statistically estimated. In such a case of ‘probabilistic uncertainty’ (on this point see Knight 1921), decision-makers possess only fragmentary information about the true state of affairs but are able to gain relative assurance with little effort. Once an approximation of risk exists, it is then possible to categorize risk, to break it down into more ‘tangible’ or ‘workable’ factors, and to classify risk groups and even types of capital (on categorization strategy, see Knight 1921: 224-239).

In the case presented here, the national supervisory authorities had already addressed the problem of shielding against credit risks and developed strategies that reflected each country’s tradition in regulation (risk-based or fixed-rate). Common to each of these approaches was the attempt to create categories of risk and to link types of business transactions to levels of capital reserves. Thus, each of the countries represented in the Basle Committee had its own historically evolved model of regulating risk, and these models could co-exist without any problem as long as the banking business of each country remained primarily within the country’s borders.

The need for cooperation and consensus between the community of nations arose once it became clear that the international consequences of bank collapses could no longer be effectively minimized by the requirements of a national regulatory authority or by the intervention of a central bank. By internationalizing their business, banks were able to take greater advantage of exit-options and to transfer business to supposedly less regulated foreign countries. At this point the inadequate territorial range of national regulations became blatant.

So, by the mid-1980s, a situation had emerged in which all actors were essentially interested in establishing international standards for capital adequacy, because such a step promised to prevent situations in which central banks would be forced to compensate for the consequences of foreign bank collapses. At the same time, every national regulatory authority attempted to minimize the costs of adopting a collective solution. Instead, the actors’ preferences reflected a ‘path dependency’ influenced by national traditions in regulation-every country strove for a solution most closely related to its own national model. Thus, distributional conflicts within the community of nation states hampered cooperation.

In the terminology of game-theory, the constellation of problems and interests can be interpreted as a battle of the sexes (Martin 1993; Scharpf 1989). This is a coordination game with two centers of gravity; although both partners share a basic interest in cooperating with each other, every cooperative solution is linked with the acceptance of a distributional advantage for the one or the other side. Should the two parties, however, agree on a single center of gravity, it is improbable that either one would ever deviate from it. This is also the reason why it becomes unnecessary in coordination games to establish mechanisms for monitoring and enforcing solutions, once solutions are agreed upon.

In the case presented here, the change in preferences by the United States, one of the largest banking markets and thus one of the most important players, led to the preliminary decision on the ‘focal point’ in the distribution conflict. The ensuing alliance with Great Britain avowed America’s commitment to a risk-based solution on the issue of capital adequacy and at the same time substantiated the implicit threat to exclude uncooperative member states, particularly Japan, from its market in the future. Politically, this power play by the major powers broke the existing stalemate on technical issues that had been preventing agreement. This form of ‘sequential handling’ of distributional and technical issues 16 in the negotiations was the key that finally unlocked the door to a consensus on a standard that superseded the content of the bilateral agreement. Knowing preliminary decisions had already been made on the general direction of a collective solution, the technical working groups found it much easier, based on experience, to categorize and thereby ‘work through’ the matters to be negotiated. Once such a standard had been established, it could be implemented on the national level within the framework of each country’s regulatory tradition, and competitive pressure could be used to accelerate the implementation process.

Since the early 1990s, the banking sector has clearly entered a second ‘phase of de-nationalization’ in which regulation problems differ considerably from those of the first phase. As financial intermediation is increasingly taking place through capital markets instead of bank lending, financial relations tend to become more short-term oriented, anonymous and market based. New types of financial risks arise that are dependent on market fluctuations to an unprecedented degree and are therefore difficult to predict. Unlike in the 1980s, actors now find themselves in a situation of high-level uncertainty with regard to possible procedures and techniques for safeguarding against risk. Established, standardized forms of measuring capital adequacy are still practiced but seem less and less suited to deal with a complex, ever-changing subject matter.

It can no longer be assumed that the community of governmental regulators possesses the necessary expertise on the means of limiting market risks in order to solve emerging problems and remain well within national regulatory traditions. On the one hand, there are no ‘path-dependent’ preferences to be negotiated in intergovernmental bodies. 17 More often than not, evident imbalances in expertise between the state and the banks means that the state does not possess the know-how to establish a set of uniform regulations. On the other hand, banks are now exploiting governmental ignorance more and more by proposing ‘cheap’ solutions concerning capital reserves, even though all governments largely prefer ‘safer’ ones. At the same time, the reoccurring failure of banks to correctly forecast the risks of their own loan portfolios has shown that the knowledgeable edge bankers claim to have is not great enough to justify any clear-cut preferences for a capital quota (that is as low as possible). Instead, all actors are finding themselves in a situation of collective uncertainty in which it is not possible from the outset to say where a cheaper solution or a safer one would work better. Which capital-to-asset ratio should one advocate when the market situation can change dramatically each hour?

Unlike in the first case, those involved in regulation are facing a situation in which the uncertainty emanates not (primarily) from the constellation of actors involved but from the circumstances in which they find themselves. In this game against nature, desired outcomes cannot be brought about through the negotiation by actors such as the state or banks because negotiated solutions require that the preferences of the negotiating parties are known. Here, however, the complexity of the subject-matter creates a gap of negotiability. Now the issues revolve around processing information instead of settling conflict and around generating know-how in a controlled fashion instead of codifying norms.

The new regulatory approach is also based on a new type of cooperation between the state and banks in the regulatory process and linked with a specific division of labor: the task of calculating risk lies now in the hands of private enterprise. Banks producing exceptionally accurate prognoses are rewarded by having the costs of insuring against risk lowered. The task of domestic regulators is to review periodically advances in the private sector’s expertise, to invoke sanctions against the banks for their failings, and thereby to make the ultimate decision on how capital adequacy is measured. This mixture of incentive-based self-evaluation and sanction-contingent state monitoring 18 requires well-developed channels of communication and exchange on the national level between domestic supervisors and global players. Naturally, it is not possible amidst such uncertainty to eliminate completely the pursuit of interests on each side, because the state and banks would, in principle, each prefer different solutions toward distribution. Nevertheless, this pursuit of interests is initially reigned in because it is not possible at this point for either side to specify clear-cut preferences and negotiate a balance between them. Rather, the overriding factor currently is the process of continued mutual training for both the banks and the state. For the banks, the important thing is to optimize their own strategies for calculating risk and to establish new, in-house structures to control risk management. For its part, the state must also ‘educate’ itself if it intends to avoid the danger of becoming the victim of a growing asymmetry in the levels of financial expertise (‘capture’).

In the new model of regulation, it is the national level that offers the spatial and communicative proximity of the regulators and the regulated in which variations of the models are tried out and new solutions to reduce uncertainty are sought continually. Unlike the case of negotiated standardization, the line between stipulating regulations and implementing them is blurred. Instead, ‘bottom-up’ models of risk management are structured primarily to establish national variations of discovery procedures. In principle, varieties of national solutions tend to ‘unlevel’ the international playing field again or might even lapse into an undercutting race among states again. Against this background, it is extremely important that national inputs drive the continuing harmonization processes on the international level. In the new model, it is precisely the interplay between the national and international levels that could master the complexity of this new, territorially expanded, financial world.

| Basle Accord | In-house Approach | |

| Problem type | Distribution | Knowledge generation |

| Interest constellation | ‘Battle of the sexes’ | ‘Game against nature’ |

| Regulation type | Bargaining | Communication and learning |

| Actors | Public | Public and Private |

| Regulatory direction | Top-down | Bottom-up |

| Optimization goal | Range | Range and flexibility |

| Result | Standard | ‘Flexible individualized solution’ |

When the different models of international banking regulation are compared, both the strengths and weaknesses of the regime approach become evident. This approach is obviously very effective when explaining situations in which the preferences of actors are clearly identifiable and therefore negotiable. In such cases, the conditions can be identified under which governments are willing to cooperate and to work out mutually beneficial terms of an agreement. However, international negotiations only appear to solve border-transcending problems under two conditions: First, the states must have access to the necessary information that enables them to develop acceptable solutions and thereby to determine which of these they prefer. Second, the primary aim of these negotiations must be to limit, through international agreements, the number of exit-options available and thus diminish the potential danger of domestically established market actors.

Once the situation has shifted from being a game of strategy to being one of technical uncertainty, once the primary aim is no longer to extend the range of solutions but to master a labyrinth of complexities, the weaknesses of the regime approach become all too clear. International cooperation has been replaced with collaboration between regulators and those being regulated. Where there is an asymmetry of information or even collective uncertainty, one finds ‘gentler’ forms of communication and information-gathering replacing those of negotiation.

It could be possible to expand the perspective of the regime debate in two aspects. First, the role of non-governmental actors should be given greater consideration as cooperation partners of regimes and as alternative supporters of self-regulatory measures on the international level. Reference to the growing importance of ‘governance without government’ (Rosenau) has already been made (see Rosenau/Czempiel 1992; Desai/Redfern 1995; Rosenau 1995), and an ever-widening debate is now turning its attention to different forms and functions of private involvement in international affairs (see the recent volumes by Cutler/ Haufler/ Porter 1999a and Higgott/ Underhill/ Bieler 2000 as well as the article by Ronit and Schneider 1999). With regard to private regimes in the financial sector, there are already studies that examine the international associations of securities traders on the Euromarket (Porter 1993) or analyze the international mergers of insurance companies (Haufler 1993), 1997). The manner in which private rating organizations function as the intermediaries of information also has come increasingly under the scrutiny of scientific research (Sinclair 1994). Nevertheless, many of these studies appear to be relatively unsystematic. For example, no study has yet examined why certain private mergers reach agreements that are self-regulating and also benefit the public interest while other mergers do little more than create private cartels that shift the costs of their cooperation to outsiders (on the logic of international cartels, see Spar 1994). Furthermore, we need specific studies on the cooperation between public and private interests in the international context highlighting the specific ‘division of labor’ of both. The literature on corporatist-type ‘private interest governments’ on the domestic level (Streeck/ Schmitter 1985) has pointed out that private business associations rely on the help of the state in order to develop the organizational skills for producing collective goods. It is not yet clear whether there are similar mechanisms or even functional equivalents at work in global public-private partnerships.

Haufler’s historic study on risk management in the international insurance regime shows that the percentage of public or private regime elements can change significantly over time, depending on the collective problem at hand (Haufler 1997). The case-study presented here emphasizes the argument that private involvement in regulatory matters can help to expand knowledge in a situation of uncertainty (see Cutler/Haufler/ Porter 1999b: 351). Mixed regulation can be quite promising in strategic constellations resembling a ‘game against nature’, because the differing concepts on the desirable degree of self-regulation advocated by the state, on the one hand, and proposed by private actors, on the other, recede temporarily.

The second desirable expansion of the regime approach would be to take the events on the national level more seriously and to observe more closely the feedback processes linking both levels. The importance of interactive models that link domestic and international politics more closely has already been stressed by Robert Putnam, who suggests that episodes of international cooperation must be viewed as ‘two-level-games’. At one level, representatives of different countries seek to reach or sustain international agreements; at a second level, those same representatives must build the political support required to sustain commitments and establish credibility. Often, expectations about the likelihood of gaining aceptance in one arena influence the bargaining process in the other (Putnam 1988). Putnam’s model does in fact capture some of the collaboration problems that emerged in our first case study. Here, different regulatory models on the domestic level shaped very much the preferences of the actors when negotiating the multilateral agreement. The expectation that some institutional solutions would be difficult to implement in one’s own regulatory structure and culture, very much predetermined the strategy to defend the own regulatory model in the multilateral bargaining process. Once this distributive conflict was solved and an agreement was reached, the governments had little incentive to deviate from it. In such a constellation, it is the international level where conflicts are solved whereas the nation-state acts chiefly as level on which international agreements are then implemented (on this view, see e.g. Zürn 1997).

The second case demonstrates that the domestic level can, at least temporarily, be the place where international collective problems are solved. The immense uncertainty surrounding the problem of risk management created a gap in negotiability at the international level. States did not have ‘path-dependent’ preferences when it came to other ways of risk management than the former standardized approach. However, flexible regulation is more in line with Anglo-Saxon regulatory traditions than with those of Continental countries, but flexible solutions might differ according to the volatility of the market and therefore do not necessarily generate issues to be negotiated on the multilateral level. This was the reason why the nation-state assumed a much greater role than simply acting as an agent of implementation, but had to bridge the gap of problem-solving capacity on the international level with regulated learning strategies on the domestic level. In principle, our study indicates that the multilevel system offers a requisite variety of problem-solving strategies, produced by the continuous interplay between different levels. Further research is called for in order to explore what kinds of institutional options multi-level decision-making is offering and what sort of preconditions successful problem-solving is requiring.

Artopoeus, Wolfgang (1998): Kreditrisiko — Erfahrungen und Ansichten eines Aufsehers. Speech given at the symposium ‘Credit Risk’ of the German Central Bank, 24 November 1998 (http://www.bakred.de/texte/praes/r_241198.htm).

Bank for International Settlements (1986): Recent Innovations in International Banking: Prepared by a Study Group Established by the Central Banks of the Group of Ten Countries, Basle.

Basle Committee (1995): An Internal-Model-based Approach to Market Risk Capital Requirements, Basle.

Basle Committee (1996): Overview of the Amendment to the Capital Accord to Incorporate Market Risks, Basle.

Basle Committee (1998): Framework for the Evaluation of Internal Control Systems, Basle.

Basle Committee (1999): Consultative Paper on a new Capital Adequacy Framework, Basle.

Cohen, Benjamin (1986): In Whose Interest? New Haven, Conn.

Coleman, William D.(1996): Financial Services: Globalization and Domestic Policy Change, London.

Cooke, Peter (1990): International Convergence of Capital Adequacy Measurement and Standards, in: Gardener, Edward P.M. (Ed.): The Future of Financial Systems and Services. Essays in Honour of Jack Revell, Houndsmills, 310-335.

Crockett, Andrew (1997): Speech at the Money Macro and Finance Annual Conference held in Durham, 9 November, in: BIS-Review 81, 1-10.

Cutler, Claire A./ Haufler, Virginia/ Porter, Tony (Eds.) (1999a): Private Authority and International Affairs. New York

Cutler, Claire A./ Haufler, Virginia/ Porter, Tony (1999b): The Contours and Significance of Private Authority in International Affairs. In: Cutler/ Haufler/ Porter (Eds.) (1999a): 333-377

Deeg, Richard/ Lütz, Susanne (2000): Internationalization and Financial Federalism -The United States and Germany at the Crossroads?, in: Comparative Political Studies 33:3, 374-405

Desai, Meghnad/ Redfern, Paul (Ed.) (1995): Global Governance: Ethics and Economics of the World Order, London.

Financial Stability Forum (1999): Background brief made to the Press at the 2nd meeting of the Financial Stability Forum on 15 September 1999 (http://www.bis.org/press/p990916.htm).

Genschel, Philipp/ Plümper, Thomas (1997): Regulatory Competition and International Cooperation, in: Journal of European Public Policy 4: 4, 626-642.

Goebbel, Ralf (1995): Nutzen und Risiken der Derivate aus betriebswirtschaftlicher Sicht, in: Bertuch-Samuels, Axel/ Störmann, Wiebke (Ed.): Derivative Finanzinstrumente. Nutzen und Risiken, Stuttgart, 33-79.

Goodhart, Charles et al. (1998): Financial Regulation. Why, how and where now? London: Routledge

Group of Thirty (1997): Global Institutions, National Supervision and Systemic Risk: A Study Group Report, Washington, D.C.

Haggard, Stephen/ Simmons, Beth (1987): Theories of international regimes, in: International Organization 41: 3, 491-517

Hartmann, Philipp (1996): A Brief History of Value-at-risk, in: The Financial Regulator 1: 3, 37-40 .

Haufler, Virginia (1993): Crossing the Boundary between Public and Private: International Regimes and Non-State Actors, in: Rittberger, Volker/ Mayer, Peter (Ed.): Regime Theory and International Relations, Oxford, 94-112.

Haufler, Virginia (1997): Dangerous Commerce: Insurance and the Management of International Risk, Ithaca NY.

Herring, Richard J./ Litan, Robert E. (1995): Financial Regulation in the Global Economy, Washington D.C.

Higgott, Richard A./ Underhill, Geoffrey R.D./ Bieler, Andreas (Eds.) (2000): Non-state Actors and Authority in the Global System. London/ New York

Hirschman, Albert O. (1970): Exit, Voice and Loyalty. Cambridge, MA.

Kapstein, Ethan B. (1989): Resolving the Regulator’s Dilemma: International Coordination of Banking Regulation, in: International Organization 43: 2, 323-347.

Kapstein, Ethan B. (1992): Between Power and Purpose: Central Bankers and the Politics of Regulatory Convergence, in: International Organization 46: 1, 265-287.

Kapstein, Ethan B. (1994): Governing the Global Economy: International Finance and the State, Cambridge, Mass.

Kay, John/ Vickers, John (1988): Regulatory Reform in Britain, in: Economic Policy 7: 8, 285-351.

Knight, Frank H. (1921): Risk, Uncertainty and Profit, Boston.

Krasner, Stephen D. (Ed.) (1983): International Regimes, Ithaca NY.

Lowi, Theodore J. (1975): Ein neuer Bezugsrahmen für die Analyse von Machtstrukturen, in: Narr, Wolf-Dieter/Offe, Claus (Ed.): Wohlfahrtsstaat und Massenloyalität, Köln, 133-143.

Lütz, Susanne (1998): The Revival of the Nation-State? Stock exchange regulation in an era of globalized financial markets. In: Journal of European Public Policy 5: 1, 153-169.

Martin, Lisa L. (1993): The Rational State Choice of Multilateralism, in: Ruggie, John Gerard (Ed.): Multilateralism Matters: The Theory and Praxis of an Institutional Form, New York, 91-121.

Oatley, Thomas/ Nabors, Robert (1998): Redistributive Cooperation: Market Failure, Wealth Transfers and the Basle Accord, in: International Organization 52: 1, 35-54.

Organisation for Economic Cooperation and Development (OECD) (1983): The Internationalisation of Banking: The Policy Issues, Paris.

Organisation for Economic Cooperation and Development (OECD) (1997): The Impact of Institutional Investors on OECD Financial Markets, in: Financial Market Trends, 68, Paris, 15-54.

Padoa-Schioppa, Tomaso (1997): Market-friendly Regulation of Banks: an International Perspective, in: Duwendag, Dieter (Ed.): Szenarien der Europäischen Währungsunion und der Bankenregulierung, Berlin, 117-130.

Porter, Tony (1993): States, Markets and Regimes in Global Finance. New York.

Putnam, Robert (1988): Diplomacy and domestic politics: the logic of the two-level games. In: International Organization 42: 3, 427-60

Rawnsley, Judith (1995): Der plötzliche Bankentod. Barings - Die Insider-Geschichte, Düsseldorf. (engl. version: Going for Broke. Nick Leeson and the Collapse of Barings Bank)

Reinicke, Wolfgang H. (1995): Banking, Politics and Global Finance: American Commercial Banks and Regulatory Change, 1980-1990, Aldershot.

Reinicke, Wolfgang H. (1998): Global Public Policy. Governing without Government? Washington, D.C.

Rittberger, Volker (1993): Research on International Regimes in Germany: The Adaptive Internalization of an American Social Science Concept, in: Volker Rittberger/ Peter Mayer (Eds.), Regime Theory and International Relations. Oxford: Clarendon Press, 3-23

Ronit, Karsten/ Schneider, Volker (1999): Global Governance through Private Organizations, in: Governance 12: 3, 243-266.

Rosenau, James N. (1995): Governance in the Twenty-first Century, in: Global Governance 1: 1, 13-43.

Rosenau, James N./ Czempiel, Ernst-Otto (Ed.) (1992): Governance without Government: Order and Change in World Politics, Cambridge.

Rotberg, Eugene H. (1992): Risk Taking in the Financial Services Industry, in: OECD (Ed.): Risk Management in Financial Services, Paris, 9-42.

Sabel, Charles F. (1994): Learning by Monitoring: The Institutions of Economic Development, in: Smelser, Neil J./ Swedberg, Richard (Ed.): The Handbook of Economic Sociology, Princeton, 137-165.

Scharpf, Fritz W. (1989): Decision Rules, Decision Styles and Policy Choices, in: Journal of Theoretical Politics 1: 2, 149-176

Scharpf, Fritz W. (1994): Community and autonomy: multi-level policy-making in the European Union, in: Journal of European Public Policy 1:2, 220-242

Sinclair, Timothy J. (1994): Passing Judgement: Credit Rating Processes as Regulatory Mechanisms of Governance in the Emerging World Order, in: Review of the International Political Economy 1: 1, 133-159.

Spar, Debora L. (1994): The Cooperative Edge: The Internal Politics of International Cartels, Ithaca NY.

Streeck, Wolfgang/ Philippe C. Schmitter (Eds.) (1985): Private Interest Government: Beyond Market and State. London

Taylor, Michael (1996): Banking Supervision at the Crossroads, in: The Financial Regulator 1: 1, 14-17.

White, William R. (1999): Paper presented at the conference on „Asia and the future of the world economic system", organised by the Royal Institute of International Affairs, London 17-18 March 1999, in: BIS-Review No.36.

Wildavsky, Aaron (1972): The Self-Evaluating Organization, in: Public Administration Review: 32, 509-520.

Williamson, Oliver E. (1985): The Economic Institutions of Capitalism: Firms, Markets and Relational Contracting, New York.

Zürn, Michael (1993): Problematic Social Situations and International Institutions. On the Use of Game Theory in International Politics, in: Frank R. Pfetsch (Ed.), International Relations and Pan-Europe. Münster/ Hamburg: Lit, 63-85

Zürn, Michael (1997): Positives Regieren jenseits des Nationalstaates. Zur Implementation internationaler Umweltregime, in: Zeitschrift für Internationale Beziehungen 4: 1, 41-68.

Endnotes

Note 1: On the situation-structural approach in the German adaptation of regime theory, see e.g. Zürn 1993; Rittberger 1993 as well as Haggard/Simmons 1987 with an overview of different theoretical approaches to regime change and variance. Back.

Note 2: The article presents some of the findings of a completed research project on the changes in the national and international regulation of banks and capital markets, induced by processes of globalization. Pertinent secondary literature, source material, and relevant newspaper articles were evaluated in the course of this project. In addition, approximately sixty interviews were conducted with experts in this field. In order to maintain the anonymity promised to those interviewed, they have been quoted only in an indirect and somewhat disguised manner throughout the paper. Back.

Note 3: According to OECD estimates, international commitments of the big banks in 1965 only amounted to US-$55 billion; by 1981, this figure had increased to US-$2,200 billion (OECD 1983: 16).Back.

Note 4: The history of the ‘Basle Accord’ has been examined relatively well; see the work on the events leading to and negotiation of the accord in Kapstein 1989 and 1992; Cooke 1990; Reinicke 1995, theoretical reinterpretations of the case from the regime perspective are in Genschel/ Plümper 1997 and from a rent-seeking perspective in Oatley/ Nabors 1998. Back.

Note 5: The International Monetary Fund is an international organization with currently 182 member countries. It was founded in 1945 in order to supervise the stability of foreign exchange rates and to help its members by offering emergency loans when international balance-of-payment deficits arose. Since the 1980s, the IMF has turned its attention more and more to international crisis management. Back.

Note 6: The Basle Committee was established in late 1974 by the central bank governors of the G10-countries after the collapse of the Herstatt Bank created serious upsets in the international foreign exchange markets and bank-lending markets. The committee’s assigned task was to examine methods to improve early warning systems and set recommended minimum requirements for protecting against financial risks. The committee members come from Germany, France, Great Britain, Italy, Japan, Canada, the Netherlands, Switzerland, Sweden, Luxembourg, Belgium, and the United States. Each country is represented by its central bank and by its official supervisory body.Back.

Note 7: The Fed; the Office of the Controller of the Currency, OCC; the Federal Deposit Insurance Corporation, FDIC. Back.

Note 8: See also Deeg/Lütz 2000 who argue that the more regulatory safety standards in the banking sector converge on the international level, the more regulatory authorities coordinate their efforts on the national level, thereby tending to make federal systems become more centralized. Back.

Note 9: The value of investments in the hands of institutional investors within the OECD, for example, increased between 1981 and 1995 from US-$3.2 trillion to more than US-$24.3 trillion. Between 1990 and 1995 alone, the annual growth rate of institutional investors within the OECD averaged 11 percent (OECD 1997: 15-16). Back.

Note 10: In Williamson’s terminology, this is considered a form of ‘relational contracting’ (Williamson 1985). Back.

Note 11: See Reinicke 1998: 118 ff., the only reference to date on the growing importance of private input in issues of international banking regulation.Back.

Note 12: In a similar fashion, the IIF proposes the establishment of an advisory body from private enterprise that would encourage consultation on a regular basis between the World Bank, the IMF, banks and securities firms (Frankfurter Allgemeine Zeitung, 9 April 1998:18). Back.

Note 13: In principle, it will also affect the relationship between each of the global players and their banking clubs on the worldwide level. Still, it remains unclear whether competition between the global players will prevent an open exchange of information about adequate risk management strategies. Back.

Note 14: See BIS press release from 12 March 1998. Back.

Note 15: See Lowi 1975 on the thesis that ‘policy determines politics’.Back.

Note 16: More on this typical solution of a distribution conflict in Scharpf 1989. Back.

Note 17: There are however, path-dependent preferences with regard to the extent of flexibility used in the new approach. Back.

Note 18:

The coupling of continual monitoring and self-evaluation resembles the ‘self-evaluating organization’ propagated by Wildavsky (Wildavsky 1972) or also Charles Sabel’s ‘learning by monitoring’ (Sabel 1994). Back.